salt tax repeal march 2021

Web Elrich says not so fast on SALT tax cap repeal. Web Certain members of the House and Senate want the SALT deduction cap removed which would benefit primarily higher earnersand result in a 380 billion reduction of federal revenue through 2025 when the SALT cap is scheduled for repeal.

Salt Cap Repeal Disproportionately Favors Wealthy People R Neoliberal

No SALT No Deal - Will Oppose Any Changes to Tax Code Unless Cap on SALT Deduction is Repealed March 30 2021 Press Release With only a 3 vote.

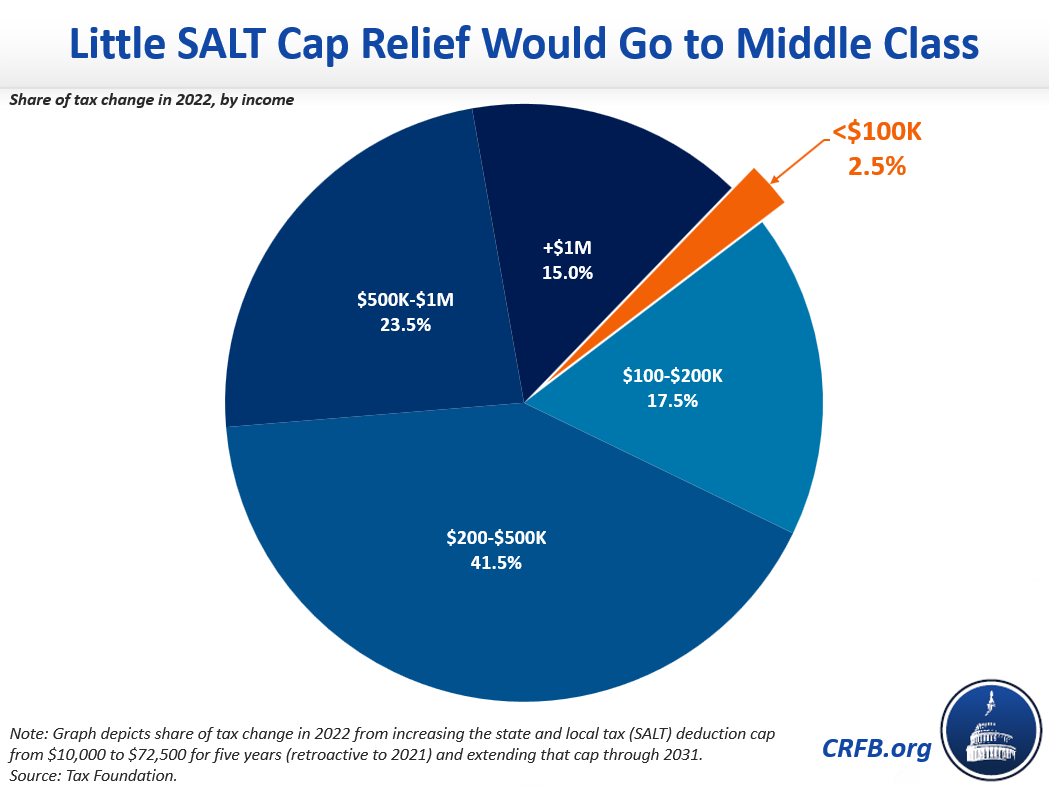

. SALT cap repeal is no middle-class tax cut New York the top 1 percent would get a tax cut of about. Web Former President Trumps Tax Cuts Jobs Acts put a 10000 cap on how much a federal taxpayer could deduct for state and local taxes paid. Web Raising the SALT cap from 10000 to 80000 would almost exclusively benefit the highest 20 of tax filers who are households earning more than 175000 a.

Web While 96 percent of the repeals savings would go to the top fifth of earners the middle 60 percent of earners would save an average of 27 annually Brookings. Web In a joint statement after the tax plans release Ways and Means Committee Chairman Richard Neal of Massachusetts Rep. Web A number of local Congress members were at the home of a White Plains homeowner Thursday to call for a repeal of the 10000 cap on state and local tax.

Policymakers are considering other options to reform or repeal the SALT deduction cap. Web The SALT outlook for 2021. Web The bill would have raised the cap to 20000 for joint returns for 2019 and eliminated it for 2020 and 2021 for taxpayers with incomes below 100 million.

State and local taxation administration and policy as with most aspects of the economy. Tom Suozzi of New York addressed. Web Full repeal of the SALT cap is the worst option of all.

Web The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes. By Ana Radelat November 4 2021 900 am. Web We examine how the repeal of the state and local taxes SALT cap in 2021 would affect federal revenue and the tax liabilities of taxpayers in each of the 50 states.

Various proposals are under discussion in Congress this week. A new bill seeks to repeal the 10000 cap on state and local tax deductions. March 29 2021 900 AM.

Americans who rely on the state and local tax SALT deduction at tax time may. Of New Jersey and Rep. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT.

Web Repeal of NOL and Credit Limits. This reinstates the NOL deduction and the business tax credits a year early as the California legislature originally imposed the limits for 2020 2021 and 2022 to raise. Web Key Points.

SB 113 repeals the NOL suspension and the 5 million annual cap on business tax credit claims for tax years beginning after January 1 2022. The lawmakers have asked the US. Web March 1 2022 600 AM 5 min read.

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

California Expands Salt Workaround And Repeals Nol And Business Credit Limits Weaver

Is Salt Kosher Democrats Favorite Tax Cut For The Rich Arcadia Political Review

Salt Tax Repealed By House Democrats The Washington Post

72 500 Salt Cap Is Costly And Regressive Committee For A Responsible Federal Budget

Gottheimer Proposes Closing The 1 Trillion Annual Tax Gap Targeting Tax Cheats To Pay For Salt Cap Repeal Insider Nj

Salt Cap Repeal Salt Deduction And Who Benefits From It

The Salt Outlook For 2021 Accounting Today

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland

Update Mississippi Attempts To Significantly Increase Sales And Use Taxes On Internet Based Business Services Via Regulatory Amendment Cooking With Salt

Salt Tax Deduction Democrats Uncertain Over Ending Federal Cap

House Bill To Temporarily Repeal Salt Deduction Cap To Get Floor Vote The Hill

Biden S Just Enacted Tax And More Bill Is Salt Free Don T Mess With Taxes

House Democrats Push For Repeal Of Rule Blocking Salt Cap Workaround

Chuck Schumer Salt Deduction Cap Repeal Tax Bailout For Rich Liberals National Review

Letter Argument Against Salt Tax Repeal Misleading

Year End Tax Planning For Biden Tax Plan

Democrats Consider Salt Relief For State And Local Tax Deductions